Highlight 26/2022 – Inflation is here to stay

Munkhbayar Batsuuri, 3 May 2022

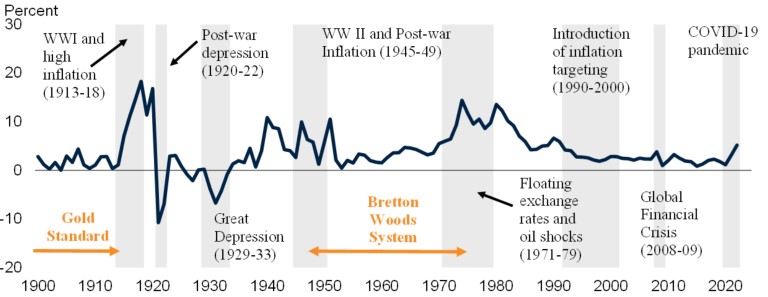

Countries are seeing highest inflation levels in decades[1]. US consumer prices rose 8.5% in March 2022 compared to the previous year. According to the preliminary data from Eurostat, inflation reached 7.5% in the Eurozone while it stands at 61.1% in Turkey, 7% in the UK, 1.5% in China, and 0.6% in Japan (February 2022). The soaring inflation rate is a global phenomenon with a few exceptions in East Asia.

The ongoing inflation crisis stems from the massive government funded relief programs that injected trillions of dollars into the economy during the pandemic. The COVID-19 lockdowns and restrictions caused major disruptions in the global supply chains and we are still dealing with supply shortages and logistical complications with roughly 1 in 5 container ships stuck at ports worldwide[2].

Russia’s invasion of its neighbor, Ukraine, has pushed up energy and food prices at a time when consumer price growth was reaching its highest levels in various countries. For many households, the rising prices could lead to a struggle to afford food, shelter and other basic needs. The Russia-Ukraine war coupled with China’s latest lockdowns have deteriorated the already fragile global supply chain.

In its latest “World Economic Outlook” report released on 19 April 2022, the International Monetary Fund (IMF) projected global growth “to slow from an estimated 6.1 percent in 2021 to 3.6 percent in 2022 and 2023. This is 0.8 and 0.2 percentage points lower for 2022 and 2023 than projected in January”[3]. The IMF also reassessed inflation rates to be 5.7% in advanced economies and 8.7% in emerging market and developing economies (EMDE) which is 1.8 and 2.8 percentage points higher than the original projection in the beginning of the year.

Central banks have already started tightening monetary policy to keep inflation in check. Borrowing money is less attractive now as interest payments on personal loans, mortgages, and on credit cards rises. Interest and saving rates go hand in hand, thus making savings more attractive during these times. Although tight monetary policy is essential, there is no “one size fits all” approach and the policies have to be specifically attuned to each country’s unique situation. As countries aim to build its resilience, reduce its dependence on others and adopt individual policies, we must be mindful of the fact that international cooperation and policy coordination is more important than ever. The inflation surge has been driven by supply chain disruptions and built up demand as a result of the COVID-19 pandemic and the war in Ukraine. Besides the short term monetary policies, the main drivers of inflation must be addressed. It has been brought to light that we need to step-up our transition to renewable energy and support domestic food producers.

Munkhbayar Batsuuri, Highlight 26/2022 – Inflation is here to stay, 3 May 2022, available at www.meig.ch

The views expressed in the MEIG Highlights are personal to the author and neither reflect the positions of the MEIG Programme nor those of the University of Geneva.

[1] Quartz, “Inflation rates are rising around the world”, available at https://qz.com/2153852/inflation-rates-are-rising-around-the-world/ (last accessed 23 April 2022)

[2] Fortune, “China’s COVID-19 lockdown is inflaming the world’s supply chain backlog, with 1 in 5 container ships stuck outside congested ports”, available at https://fortune.com/2022/04/21/china-covid-lockdown-shanghai-port-supply-chain-backlog-container-ships/ (last accessed 24 April 2022)

[3] IMF, World Economic Outlook April 2022, available at https://www.imf.org/en/Publications/WEO/Issues/2022/04/19/world-economic-outlook-april-2022